A living trust also known as a revocable trust or inter vivid trust is an estate planning document that allows someone to place assets into a trust for their own benefit during their lifetime.

Living trust ny cost.

The grantor the creator of the trust will continue to benefit from their assets and income until such a time that they become incapacitated or die in which case it will be divided amongst the indicated beneficiaries.

How much does a living trust cost.

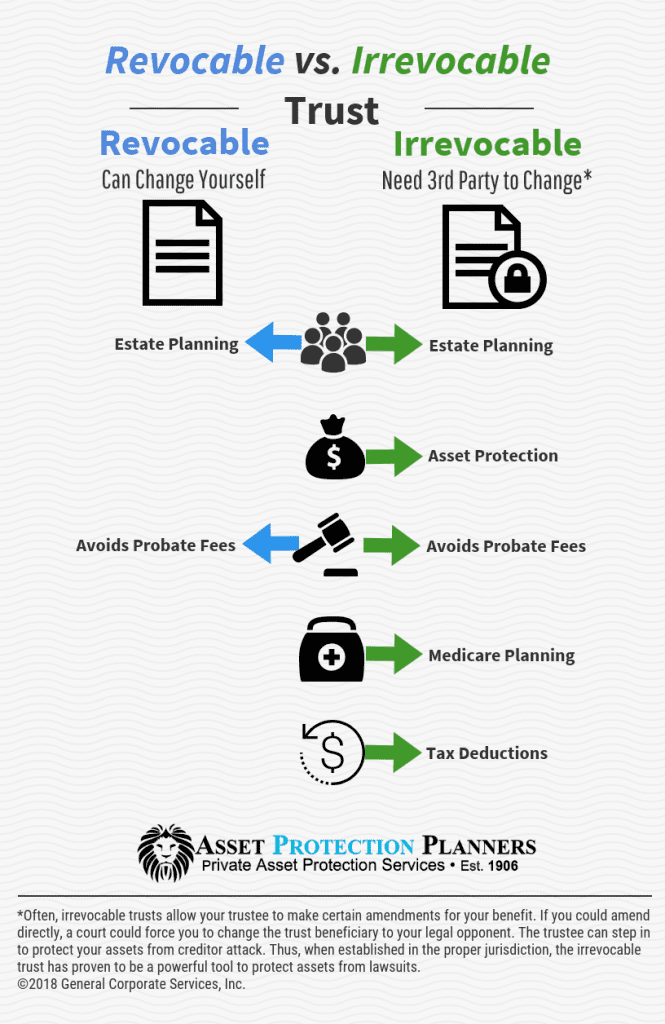

A living trust is revocable meaning it can be changed at any time during your lifetime.

Under new york law and the laws of most jurisdictions the grantor can also be the trustee.

Using an attorney means that the trust will be completed correctly but the associated fees can greatly increase the cost of creating a living trust.

Assuming you decide you want a revocable living trust how much should you expect to pay.

A revocable living trust sometimes known as an inter vivos trust provides many advantages that may make it a desirable part of your estate planning process.

If you hire a lawyer to do the job for you get ready to pay between 1 200 and 2 000.

New york does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid new york s complex probate process.

A living trust is a way to transfer money property and other assets to your heirs without having to go through long and expensive probate court procedures.

The new york revocable living trust form is a legal document that is used to put a person s assets and property into a trust.

If you are living in new york and thinking about creating a living trust this article will provide you with all of the relevant information you need including a step by step guide through the process.

It only becomes permanent or irrevocable upon your death.

A living trust in new york allows you to place your asset into a trust but still use them during your lifetime.

The living trust is revocable and amendable so if the grantor changes his or her mind about who should inherit or how much the trust can either be amended or less frequently revoked.

New york has a simplified probate process for small estates under 30 000.

Once they die the beneficiaries receive the remaining assets in accordance with the trust s terms.

When you create.

If you are willing to do it yourself it will cost you about 30 for a book or 70 for living trust software.

The average cost for an attorney to create your trust ranges from 1 000 to 1 500 for an individual and 1 200 to 1 500 for a couple.

Your beneficiaries inherit them after your death.

:max_bytes(150000):strip_icc()/GettyImages-1175314772-acd2bb149c894f5c8f84123f7f24b27b.jpg)